Contents

Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Traders need to coexist peacefully with the twin emotions of greed and fear. Paper trading doesn’t engage these emotions, which can only be experienced through actual profit and loss. In fact, this psychological aspect forces more first-year players out of the game than bad decision-making.

When stock market prices fluctuate very sharply, this is known as stock market volatility. This guide will unravel each of these basic stock market concepts, giving you a solid investing foundation to build upon in the future. The difference between long-term investing and stock trading. To increase your portfolio’s diversification, purchase companies or funds in a different industry.

However, before you can https://topforexnews.org/ buying and selling stocks, it’s important to understand the different types of orders and when they are appropriate. Study the basics oftechnical analysisand look at price charts—thousands of them—in all time frames. Do not stop reading company spreadsheets, because they offer a trading edge over those who ignore them. However, they won’t help you survive your first year as a trader.

Automated investment

When you invest in stock, you buy ownership shares in a company—also known as equity shares. Your return on investment, or what you get back in relation to what you put in, depends on the success or failure of that company. If the company does well and makes money from the products or services it sells, its stock price is likely to reflect that success. If you don’t already have an account, you can open one with an online broker in a few minutes. But don’t worry, opening an account doesn’t mean you’re investing your money yet.

- Concern about investing during an economic recession can trigger stock market sell-offs, although that’s not the only factor that can cause a big market slump.

- This strategy is not permitted by certain CFD brokers , and the account may be suspended as a result.

- Just keep in mind that robo-advisors may not be your first choice if you want to buy stocks.

- Alibaba spin-off Ant Group was set to have an even bigger IPO than its parent company … then the Shanghai and Hong Kong Exchanges suspended it.

If the stock price has gone up since when you first bought it, you may have to pay capital gains taxes. Gains on shares you owned for a year or less are subject to the higher ordinary income tax rate, up to 37%, depending on your income. Shares sold after more than a year get taxed at the lower long-term capital gains rate of 0% to 20% in 2020. For wealthy individuals without a lot of extra time to stay on top of their complicated financial lives, full-service brokers offer special treatment as well as a high level of trust. If all you want to do is buy stocks, a direct purchase plan or an online brokerage is a better choice. Another important investing essential is understanding the benefits of having a diversified portfolio.

What Are the Margin Requirements for Day Traders?

A day trader may find a stock attractive if it moves a lot during the day. That could happen for a number of different reasons, including an earnings report, investor sentiment, or even general economic or company news. There was a time years ago when the only people able to trade actively in the stock market were those working for large financial institutions, brokerages, and trading houses.

As the saying goes, if you https://forex-trend.net/ know yourself, the stock market is an expensive place to find out. Practice with virtual money before you use any of your own. You will need to do your analysis, which itself can be extremely complex, find the right stock, enter a position and then manage the trade until you decide to exit. Because of this, it may be recommended that you first start by holding your positions for a more extended period.

If the strategy is within your risk limit, then testing begins. Manually go through historical charts to find entry points that match yours. Note whether your stop-loss order or price target would have been hit. Determine whether the strategy would have been profitable and if the results meet your expectations. In many cases, you will want to sell an asset when there is decreased interest in the stock as indicated by the ECN/Level 2 and volume. The profit target should also allow for more money to be made on winning trades than is lost on losing trades.

Additional Stock Order Types

Other times that same industry could be stagnant and have little investor appeal. Like the stock market as a whole, sectors, industries and individual companies tend to go through cycles, providing strong performance in some periods and disappointing performance in others. This is a risky strategy, however, because you must still re-buy the shares and return them to your firm.

If you take profits over the course of two months or more in a simulated environment, proceed with day trading with real capital. Interactive Brokers and Webull are two recommended online brokers for day traders. Here’s a variety of stock trading tips from some very successful investors. By applying any of the following lessons, you can become a better trader. Success takes time, and these rules will lead you in the right direction. News sites such as CNBC and MarketWatch serve as a great resource for beginners.

Automated investment management is available through Robo-advisory services, an automated investment adviser. In truth, the amount of money required to purchase a single share of stock depends on how costly the shares are. It is possible to buy shares for only a few dollars or as much as several thousand dollars. It’s essential to look at operating revenue when choosing a stock because it is derived from the company’s primary activities. Non-operating revenue is frequently obtained from one-time commercial activity, such as the sale of an asset, rather than ongoing operations. To learn more about the most popular stock trading patterns, be sure to watch the video below.

There are two https://en.forexbrokerslist.site/ of stock, common and preferred—and a wide array of classes and subclasses. When someone says “the market is up” or that a stock “beat the market,” they are usually referring to a stock index. They say the best way to learn a new language is through total immersion. That means that if you want to learn German, you should go live in Germany and speak German every day.

The NYSE is home to nearly one-quarter of the world’s market cap. When there are more prospective buyers than sellers, the price goes up. My premarket market briefings will help you keep up with the current market. I want you to watch this video and think about something super trader Roland Wolf says. You’ll have a lot of choices to make when you start trading as a beginner. There are a lot of reasons for this, not all of them good.

How to Invest in Stocks

People often think fundamental analysis is only for long-term traders and investors. It’s a good idea to learn both and know when to put them to use. For the beginning investor, mutual fund fees may be more palatable compared to the commissions charged when you buy individual stocks. Plus, you can invest less to get started with a fund than you’d probably pay to invest in individual stocks.

Commonly traded stocks include Boeing, Xerox and Apple, the latter of which is traded on the Nasdaq 100, Dow Jones and the S&P 500. In our view, the best stock market investments are often low-cost mutual funds, like index funds and ETFs. By purchasing these instead of individual stocks, you can buy a big chunk of the stock market in one transaction.

It’s essential for investors to have a way to keep track of market developments and make informed decisions about their next move. Vanguard advises that international stocks should make up to 40% of your portfolio, or you can invest in international mutual funds to gain exposure to the global equity markets. A bid price is the highest amount you’re willing to pay to purchase a share of a company’s stock. The asking price, on the other hand, is exactly the reverse.

If the strategy exposes you to too much risk, you need to alter it in some way to reduce the risk. Once you have a specific set of entry rules, scan more charts to see if your conditions are generated each day. For instance, determine whether a candlestick chart pattern signals price moves in the direction you anticipate. Limit orders can help you trade with more precision and confidence because you set the price at which your order should be executed.

On the other hand, preferred stockholders are lower on the list than bondholders. Fractional shares, which means you can buy a portion of a share if you can’t afford the full share price. Stock analysis tools, on-the-go alerts, easy order entry and customer service.

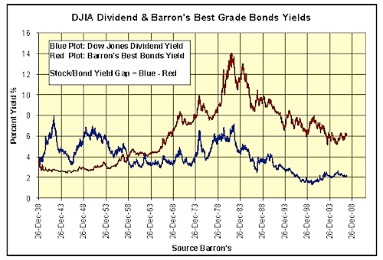

You don’t need to know all of the technical details of how to buy and sell stocks, but having a basic understanding of how the markets work is important for an investor. In contrast, some industries, such as travel and luxury goods, are very sensitive to economic ups and downs. But their share prices can rebound sharply when the economy gains strength, people have more discretionary income to spend and their profits rise enough to create renewed investor interest. Thus, their stock price generally tracks with economic cycles. When companies are profitable, they can choose to distribute some of those earnings to shareholders by paying a dividend.

In addition, there is a straightforward price schedule as well as a flat fee structure. Stag is a slang term for a short-term speculator who attempts to profit from short-term market movements by quickly moving in and out of positions. For one thing, brokers have higher margin requirements for overnight trades, and that means additional capital is required. A day trade is exactly the same as any stock trade except that both the purchase of a stock and its sale occur within the same day, and sometimes within seconds of each other. Combined, these tools provide traders with an edge over the rest of the marketplace. Regardless of what technique a day trader uses, they’re usually looking to trade a stock that moves .

Similarly, pay attention to geographic diversification as well, if possible, as geopolitical or natural events can end up affecting your investments. A few of your stock holdings may benefit from a shift to more cautious fixed-income assets if you’re nearing retirement. This strategy is not permitted by certain CFD brokers , and the account may be suspended as a result. Due to their status as an over-the-counter product, CFDs are prohibited in the U.S. as they don’t transit via regulated exchanges. Additionally, the use of leverage increases the likelihood of greater losses, which is a subject of concern for regulators. You can purchase small portions of several different equities in a single transaction with a mutual fund.

As their costs go up with interest rate increases, it becomes harder for them to stay in business. DSPs and DRIPs are usually administered for the company by a third party known as a shareholder services company or stock transfer agent. There are ways to buy stock directly through certain companies and also to have a company automatically reinvest stock dividends. Discount brokerage firms offer fewer services but, as their name implies, generally charge less to execute the orders you place. Growth stocks, as the name implies, are issued by companies that are expanding, sometimes quite quickly, but in other cases over a longer period of time.